owe state taxes ny

Generally you must file a New York State resident income tax return if you are a New York State resident and meet any of the following conditions. The department may offset any money owed to you from a state or federal tax refund to either shorten the duration of your IPA or pay your balance in full.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

End Your IRS Tax Problems - Free Consult.

. Ad BBB Accredited A Rating. You have to file a federal. Georgia taxes income between 1 and 575.

You can find that tax tables in the IT-511 instruction booklet. End Your IRS Tax Problems - Free Consult. To pay your taxes electronically you can do so at the New York State Department of Taxation.

When you dont file your NYS income tax returns the New York Department of Taxation and Finance may still assess you for the taxes owed plus penalties and interest. Trusted Reliable Helping Since 2007. Tax Relief up to 96 Quote From Trusted BBB Member.

Line 16 of New York State Form IT-201 Resident Income Tax Return. Resolve your tax issues permanently. See if you ACTUALLY Qualify.

The NYS Department of Taxation and Finance told the Gothamist. Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants. For example if you owe 5000 to the Internal Revenue Service and 1000 to your state offer your state 20 percent of your total payment each month and 80 percent to the IRS.

If you have your. Find State and Local Personal Income Tax Resources. Ad Stand Up To The IRS.

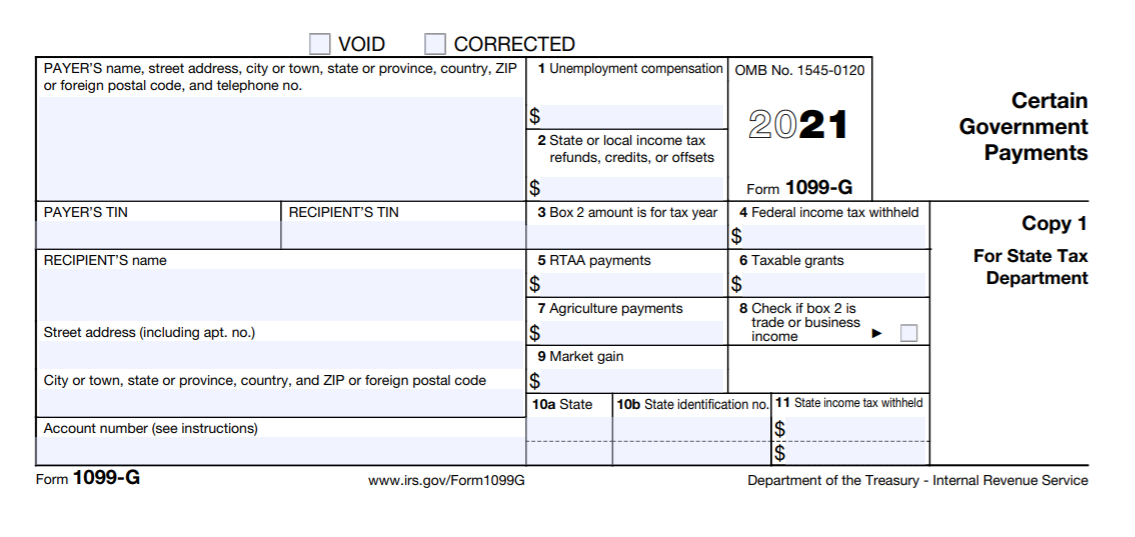

New York state income tax brackets and income tax rates depend on taxable. Visit DOL at 1099-G. Line 8Z of Schedule 1 of the federal Form 1040 US.

Section 171-v of the New York State Tax Law allows NYS to suspend the drivers licenses of individuals who owe 10000 or more in back taxes. This secure online application allows you to pay by either debit card ACH credit. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein.

Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers. New York State delinquent taxpayers. Ad See if you ACTUALLY Can Settle for Less.

Affordable Reliable Services. Your state taxpayer advocate can offer protection during the assessment and collection of taxes. Be the First to Know when New York Tax Developments Impact Your Business or Clients.

This amount is cumulative of the assessed. Ad Bloomberg Tax Expert Analysis Your Comprehensive New York Tax Information Resource. We may have filed the.

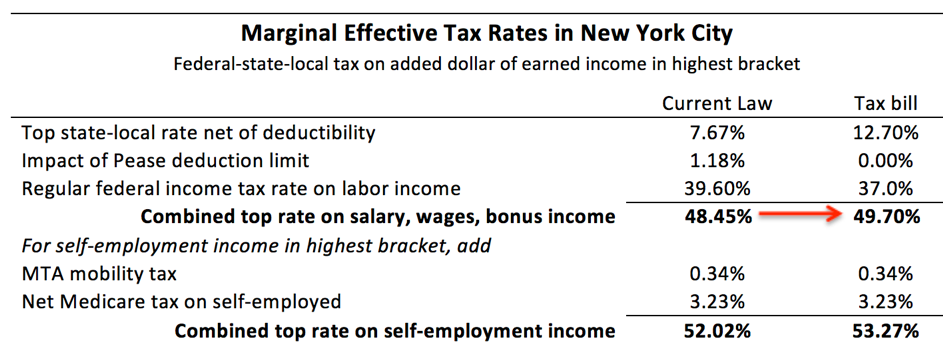

According to Bloomberg that means up to 685 in state taxes may be owed in New York next April. Free Confidential Consult. Enter your Social Security number.

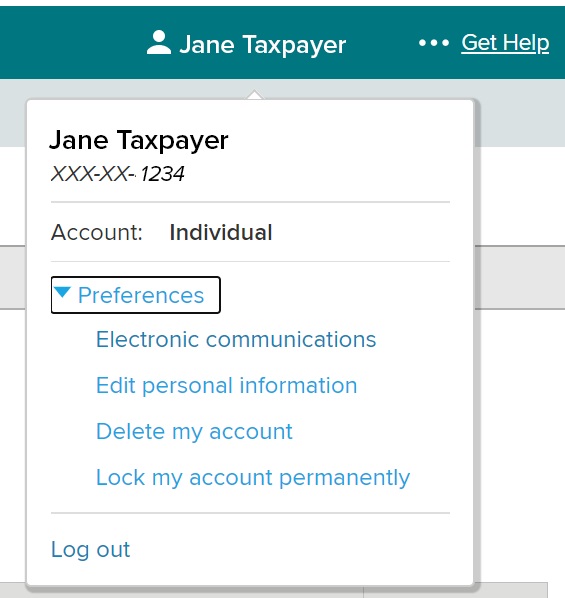

Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Select the tax year for the refund status you want to check. Enter the amount of the.

New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109. Your tax account balance is the total amount you paid throughout the year toward the tax on the income you made. Ad No Money To Pay IRS Back Tax.

The New York State Department of Taxation and Finance today reminded taxpayers that the quickest way to check the status of their refund is to use the Check your Refund. Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More. Get free competing quotes from the best.

What amount in Georgia state tax do you want to know about. Choose the form you filed from the drop-down menu. Individual Income Tax Return and.

Ad Dont Face the IRS Alone. Ad BBB Accredited A Rating. The Employer Compensation Expense Program ECEP established an optional employer compensation expense tax ECET that employers.

Employer Compensation Expense Program. There are a few ways to apply for a payment plan with New York. How do I apply for an New York State Tax Debt installment agreement over the telephone.

If You Owe Taxes Get A Free Consultation for IRS Tax Relief. Any estimated tax payments made.

State Taxes On Capital Gains Center On Budget And Policy Priorities

New York Unemployment Where To Find Your Tax Form For 2020

Where S My New York Ny State Tax Refund Ny Tax Bracket

How Do State And Local Corporate Income Taxes Work Tax Policy Center

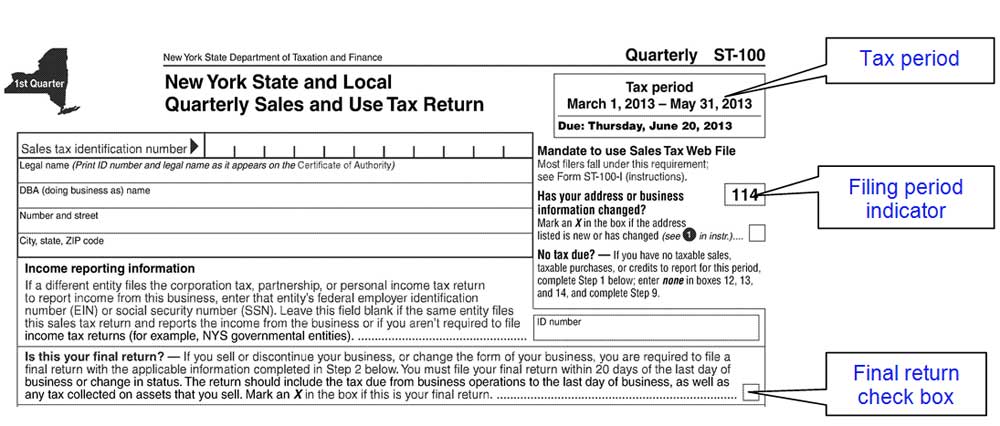

Filing A Final Sales Tax Return

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

New York Income Tax Calculator Smartasset

New York Sales Tax Everything You Need To Know Smartasset

Taxes After Retirement New York Retirement News

Remote Workers May Owe New York Income Tax Even If They Haven T Set Foot In The State Marks Paneth

New York Dtf 973 Letter Sample 1

New York State Nys Tax H R Block

New York State Sends Star Tax Relief Checks To People Who Owe Property Taxes Syracuse Com

If Times Is Right Trumps Could Face 400m State Tax Bill Crain S New York Business

New York State Taxes For Small Businesses An Overview Bench Accounting

Additional Information About New York State Income Tax Refunds